Four ways to diversify airport revenue and build business resilience

Diversity in aeronautical revenue

The first, and perhaps most straight-forward way airports can diversify their income is by attracting traffic from different countries and regions, and by having a mix of international and domestic travel. Having a more diverse traffic profile spreads traffic risk and thereby improves the resilience of airports.During the COVID-19 pandemic, no region was spared the impact of global travel bans, but domestic travel continued at a higher level and recovered faster than international travel; helping airports with a greater share of domestic traffic generate some income during the uncertainty.

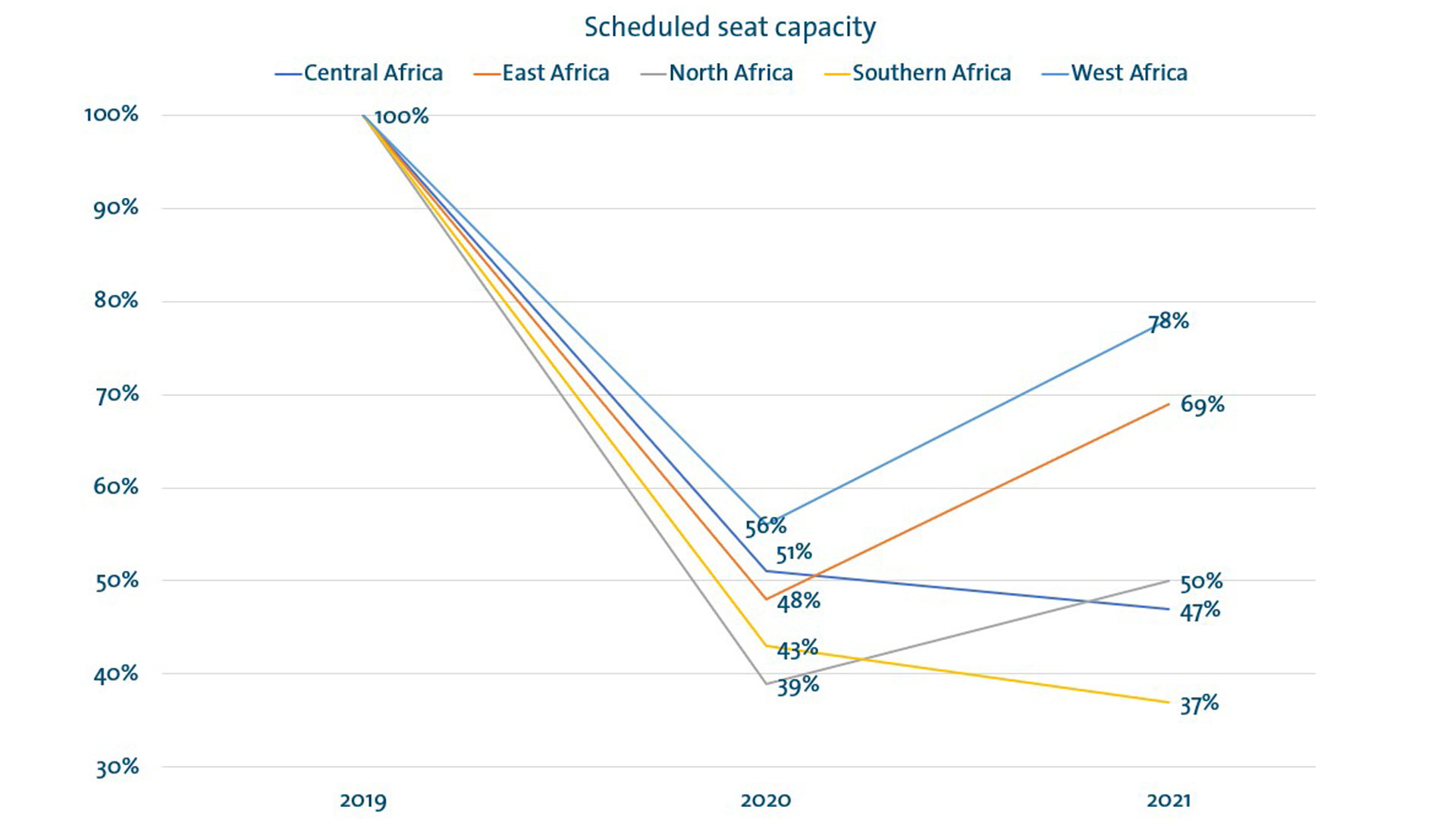

We have also seen that different regions recover at different rates. Figure 1 illustrates the recovery of scheduled airline seat capacity in different regions in Africa. It shows a disparity between East and West Africa that restored significant amounts of lost capacity in 2021, while in Central and Southern Africa capacity declined further.

Opportunities for growth in non-aeronautical revenues

Non-aero revenues can take many forms – with some being passenger-dependent like parking, retail, and food & beverage facilities, and others (cargo and real estate) offering revenues less dependent on passenger traffic.

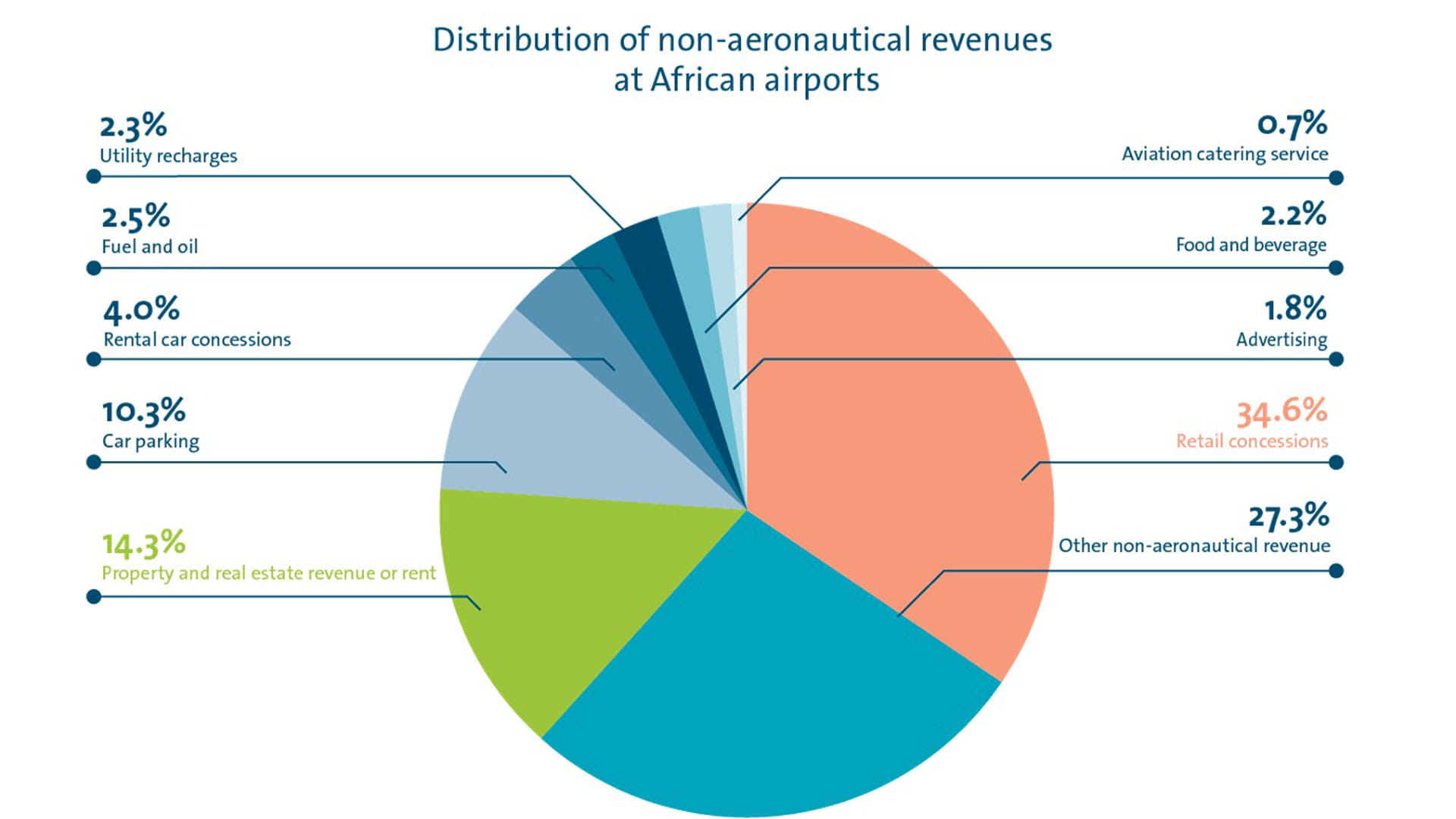

Non-aero revenues are mostly unregulated and tend to be a larger contributor to overall profits – meaning growing non-aeronautical revenues is a good thing in itself; without even thinking about diversification. Non-aero revenues today represent about 28% of total operating revenues at African airports. Globally, this figure is more than 40%, indicating there is room for growth in this area.

Airport retail – optimise and integrate

Retail is one of the most important sources of non-aero revenue for airports, representing around 35% for African airports (see Figure 2). As such, strong retail performance is key for airports in ensuring a robust income stream.

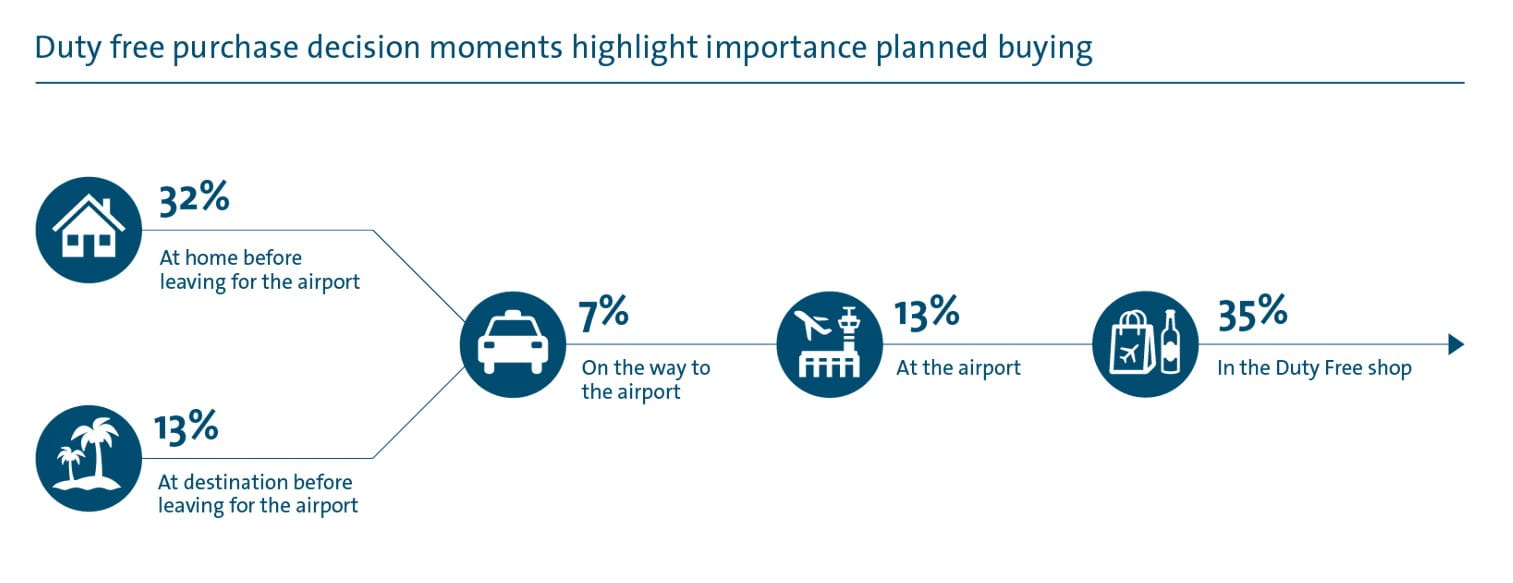

These trends and insights highlight the need for optimization of physical retail space and integration with digital platforms. Airports must create an omnichannel experience that seamlessly connects in-store shopping with virtual environments.

Digital transformation is a complex process that requires organizations to invest in digital capabilities. We have previously written about this in the context of the future passenger experience and visa processing in Africa.

Air Cargo

Air cargo is one area that offers airports an opportunity to diversify away from a reliance on passenger traffic. While revenues from cargo are estimated to represent less than 10% of airport revenues (in a regular year) spread across both aero and non-aero streams – they did provide vital income to airports during the COVID-19 pandemic.Cargo volumes have also recovered much faster than passenger volumes, with cargo traffic in 2021 already exceeding pre-pandemic 2019 levels. While the financial contribution of cargo to the airport bottom line may be limited, the strategic and economic value is perhaps more important – supporting local industries, creating better trade linkages and employment opportunities.

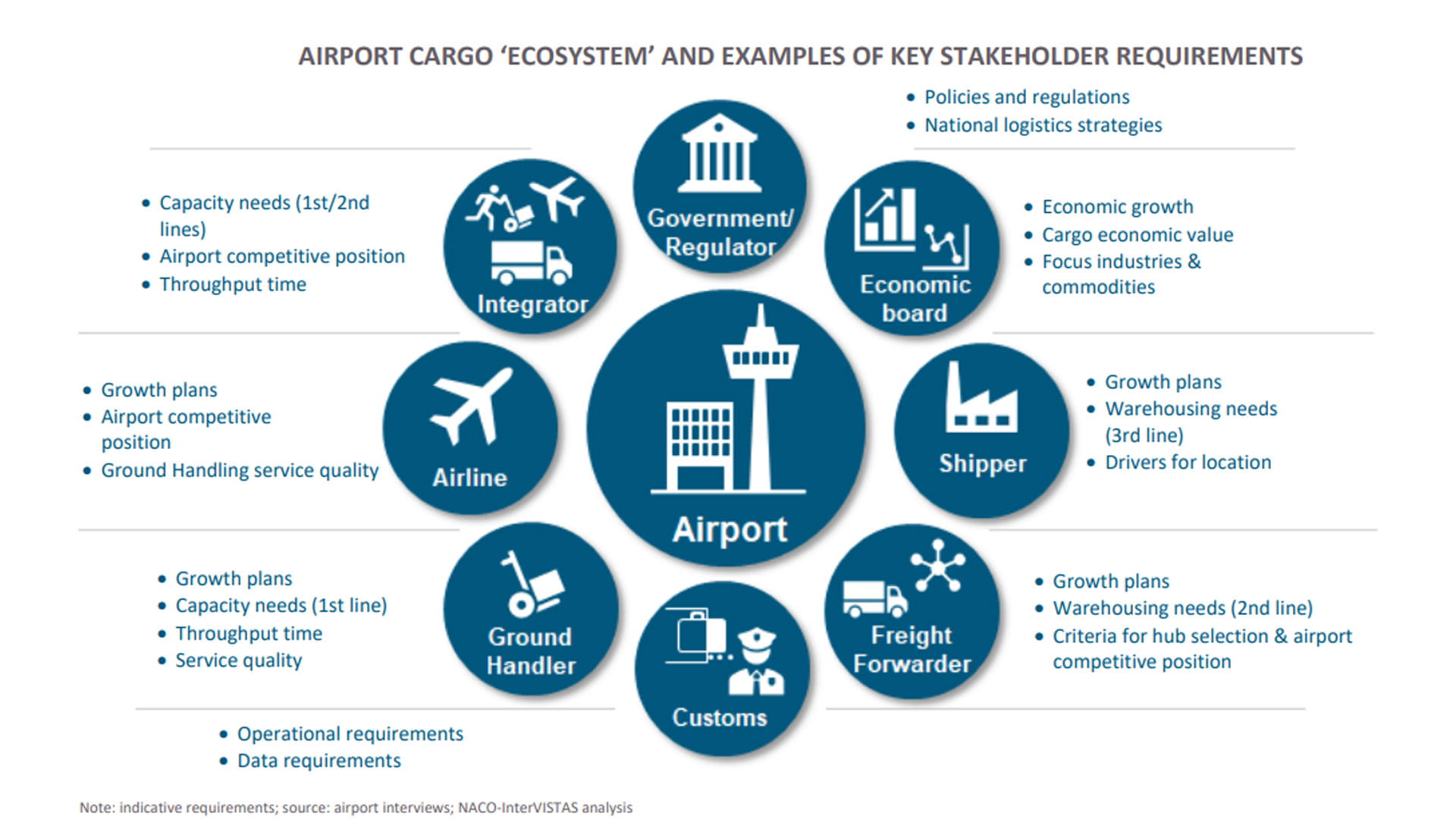

In a previous article we explored the close links between trade, air connectivity and air cargo in Africa. Airports that are an integral part of a cargo ecosystem realize both direct and indirect value that contributes to profitability and resilience (see Figure 4).

While cargo infrastructure capacity is important, successful cargo development depends on much more. To develop a strong cargo ecosystem many aspects, need to come together, and this takes time and effort. As described in our recent guideline document, it starts with understanding the current situation, gathering data and consulting with stakeholders. Based on this, a cargo vision and plan can be defined that describes the way forward for enhancing capabilities and developing infrastructure.

Airport real estate

Finally, but perhaps most importantly, there is airport real estate – which presents a big opportunity for diversification and building resilience. Many airports have large land areas at their disposal and are often located in strategic locations near cities and transport links. This makes them well suited for the development of prime property and real estate.

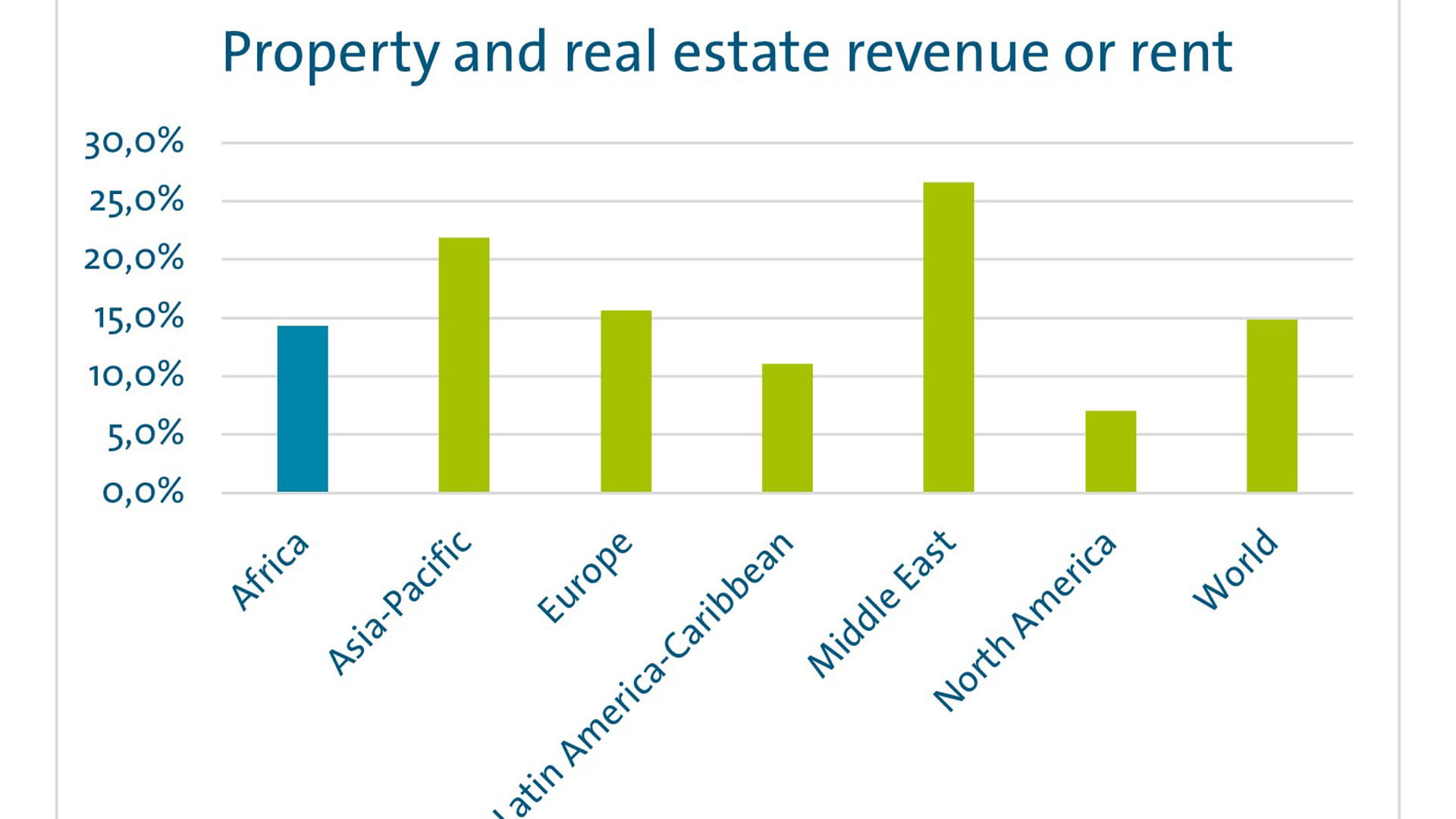

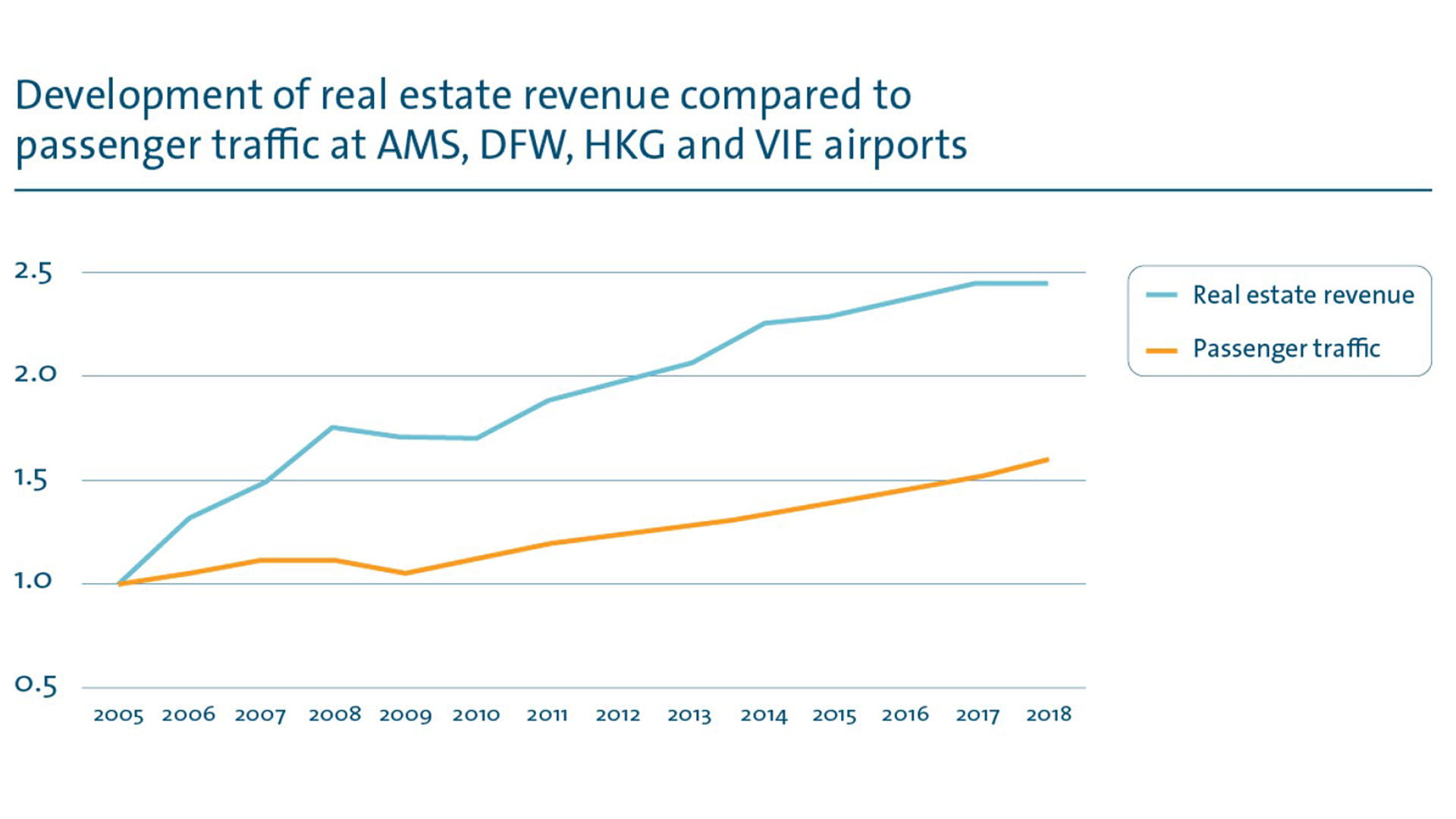

In 2018, real estate revenues made up approximately 14% of non-aeronautical revenues at African airports, compared to more than 26% in the Middle East (see Figure 5). Apart from the direct financial contribution, real estate provides a ‘cushioning effect’ for airport revenues. In a 2020 White Paper we analyzed this effect for a number of airports in Europe, North America, Asia and Africa. The data showed that growth in real estate revenues was significantly higher than growth in air traffic.

Resilient business - where to from here?

A broad revenue base with income from a variety of sources is important for airports to deal with inevitable downturns. Building income streams that are not linked to passenger traffic, such as cargo and real estate, reduce business risk in the case of an economic downturn, crisis, or pandemic.

Growing revenues in those areas starts with insights into the situation at your airport and a good relationship with stakeholders. Gathering and analysing relevant data is key to preparing targeted plans and making the right investment decisions. Investments in staff capabilities and stakeholder relationships may be as important as bricks and mortar.

When it comes to capital expenditures for infrastructure or facilities, involving specialists to determine capacity needs and appropriate business models can be key to success. Keeping these aspects in mind can support airports in building business resilience.